Asia Pacific maintains its status as a bastion for beauty and personal care and dermocosmetics momentum.

Asia Pacific is the largest region in beauty and personal care in 2021. The region accounts for at least two-thirds of beauty and personal care absolute value gains globally in the forecast period. Rising disposable incomes, rapid e-commerce acceleration pre-pandemic, substantial consumer appetite for skincare, and emerging demand for lower-penetrated categories of colour cosmetics and fragrances characterize much of the growth in the region.

Asia Pacific is also the second largest region, behind Western Europe, in dermocosmetics, which Euromonitor defines as therapeutic-positioned products that promote health and beauty of skin and hair by combining properties of cosmetics products (including but not limited to cleansing, moisturising, beautifying) and those of dermatological products (treating skin and/or scalp concerns). In 2018, Asia Pacific surpassed North America as the second most valuable dermocosmetics region and since then, has grown steadily, particularly in skincare.

Source: Euromonitor’s Passport Database, 2020

APAC consumers’ emphasis on skincare contributes to dermocosmetics growth in Asia Pacific.

According to Euromonitor’s Voice of the Consumer Beauty Survey in 2021, about one out of five (19%) APAC consumers have sensitive skin concerns, driven by stressful lifestyle, pollution and inappropriate usage of products. The COVID outbreak further propels the development of skin health awareness among consumers and drives the demand for products with proven efficacy and clinic background. Pandemic-driven wellness trends contributed to consumer behaviour changes that helped to generate healthy high-single digit growth in dermocosmetics in the region in 2020, which Euromonitor expects to continue seeing in 2022 and beyond.

China, Japan, and South Korea are the three largest dermocosmetics markets in the region. Together, they account for 24% of dermocosmetics sales globally; they also rank within the top 10 beauty and personal care markets, as of 2020. Aside from those top three markets, Hong Kong and India have also achieved high single-digit or low double-digit growth in dermocosmetics historically, driven by dermocosmetics facial care and bath and shower in Hong Kong and dermocosmetics baby and child-specific products in India. Overall, the pandemic has not slowed down demand for dermocosmetics in the region; out of the top ten markets for dermocosmetics, every region posted gains in 2020 except Japan, Hong Kong, and to a smaller extent, Vietnam.

Source: Euromonitor’s Passport Database, 2020

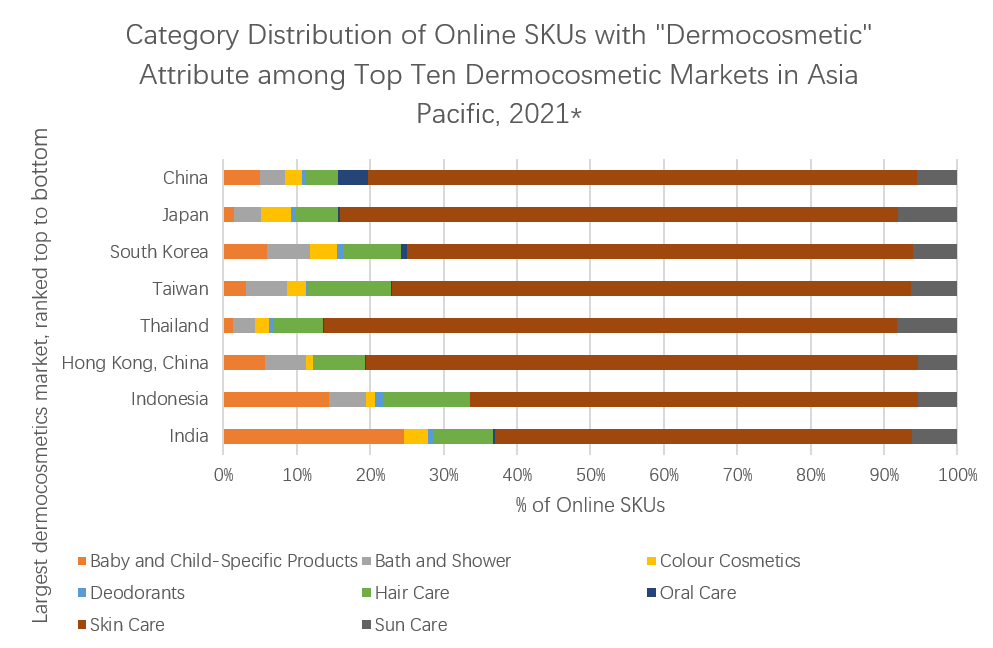

The dominance of skincare in dermocosmetics is evident in two different ways. First, skincare accounts for the bulk of the dermocosmetic market in sales, both globally and in the top dermocosmetic markets in Asia Pacific. Second, the positioning of skincare brands as having dermocosmetic features is communicated the most in skincare than in other beauty categories. According to Euromonitor’s Via Online Pricing Sample, skincare makes up the highest proportion of online SKUs tagged with the attribute “dermocosmetics” among the top ten dermocosmetics market in Asia Pacific in 2021.

Source: Euromonitor’s Via Online Pricing Sample, 1 January 2021 to 31 December 2021.

*Philippines and Vietnam are not tracked in Via and were excluded, despite ranking within the top ten dermocosmetics markets in Asia Pacific.

At the country level, dermocosmetics positioning in baby and child-specific products is more emphasized online in India than in other markets. Across the top ten markets, dermocosmetics positioning remains under-penetrated in deodorants and oral care (0.7% of dermocosmetic SKUs in both categories), which may bode well for players who wish to fill a niche in the market.

Medical-level skin repair products gaining traction across Asia Pacific

Cosmetics surgery becomes increasingly popular among Asian consumers, especially among millennial and Gen-Z urban dwellers in the last two to three years. The trend originated from developed markets such as Japan and South Korea and gradually swept across Mainland China and ASEAN markets, and even incubated many online consultation APPs such as SoYoung and Gengmei which made cosmetics surgery a more approachable beauty solution for consumers. Such beauty procedures range from hyaluronic acid injection to botulinum toxin injection, to more complicated ones such as V-line jaw and prominent cheekbones.

The prevalence of cosmetic medical procedures spontaneously drives up the demand for “aftercare” products, including but not limited to repairing facial masks, ampoule and spray, with usually comes with a dermocosmetics nature. These products are usually launched by companies with laboratory background and are recommended by beauty clinic and doctors to accelerate skin repair after medical procedures. According to Euromonitor’s Voice of the Consumer Beauty Survey, 29% Chinese consumers have used dermocosmetics skincare or hair products with doctor’s consultation, comparing with global average of 23%, demonstrating dermocosmetics brands with clinic/laboratory backup are extremely appealing to Chinese consumers. In China, popular aftercare solution are usually masks with medical device certificate which implies stricter production environment and quality check, ingredients with less additives and proven efficacy with clinical trials. Hyaluronic acid and collagen are the key ingredients of such products, usually with a pitch for skin barrier repair, while the former one focusing on water replenishment and the latter one on anti-aging.

Homegrown, domestic brands better echo consumers’ dermocosmetics needs in China

In Mainland China, homegrown brands are leveraging the national wave supported by rising culture confidence and preference towards local brands to reach new heights. Consumers’ perception towards “made-in-China” has gradually evolve from past stereotypes of “low quality with cheap price” to “made with cutting-edge technology and value for money”. Many domestic enterprises have illustrated this point through strong R&D capabilities and deeper understanding of demands from local consumers. For example, domestic enterprise Bloomage Biotech is one of the largest hyaluronic acid suppliers in the world. Leveraging its advantages in medical beauty industry, Bloomage Biotech launched several B2C brands in local market including BIOHYALUX and QUADHA both feature its high potency hyaluronic acid and advanced extracting technology. BIOHYALUX HA AQUA Single Use Essence uses INFIHA-HYDRA technology to boost hyaluronic acid absorption; and hero product Single Use Salicylic Acid Anti-acne Essence from QUADHA treats acne-prone skin with salicylic acid while repairing skin barrier with oligopeptide and hyaluronic acid.

Pharmaceutical and dermocosmetic synergy contribute to gained trust and innovation in South Korea

Local pharmaceutical companies with strong reputation in dermatologicals also perform well, as consumers are more likely to trust the efficacy of ingredients from suppliers of a medical heritage. In South Korea, for example, DongKook Pharmaceutical Co Ltd produces Madecassol, the leading topical germicidals/antiseptics brand that commands a 41% market share in 2021. The parent company incorporated the essential ingredient found in Madecassol in its dermocosmetic line, Centellian 24, with the launch of the Madeca Cream, known for its moisturizing properties to repair damaged skin.

Competitor brand Fucidin, under Dong Wha Pharmaceutical Industrial Co Ltd, recently launched Fusid Cream using a strategy similar to the one employed by The Madeca Cream. Retailers in South Korea reinforce thismessaging of ingredient efficacy by offering plenty of information through product description and consumer feedback for consumers. Companies that can leverage the pharmaceutical side of their business to innovate in the dermocosmetic side have an obvious advantage above other players, given that consumer trust and familiarity is already present.

Source: Euromonitor’s Via Online Pricing Sample, 19 January 2022.

COVID crisis continues to propel dermocosmetics in Japan

More and more Japanese consumers are experiencing unstable skin conditions such as acne and weaker skin barrier due to the unprecedented changes brought by COVID. Local dermocosmetics brand Curel unveiled a new star product in 2020 – The Curel Deep Moisture Spray is a quasi-drug product that provides moisture to both face and body for consumers who suffer from sensitive and dry skin. The product features new ceramide care technology and anti-inflammatory agent to prevent irritated skin. It’s also observed that drugstore chains also actively collaborate with leading beauty groups to co-launch dermocosmetics products. For example, Matsumoto Cocokara & Co in Japan co-developed with KOSE group and launched the first private label skincare brand RECiPEO in 2021, targeting at sensitive and dry skin. Furthermore, COVID also promotes attention for skin health in Japan, increase awareness for skin barrier enhancement besides protection against UV rays, pollen and PM2.5 over the past years. D program from local behemoth Shiseido Group designs all products to be hypoallergenic based on 50 years of delicate skin research from Japan.

Digital marketing key to success

Beyond launching on established major online platforms such as Tmall, JD.com and WeChat e-store, many fast-growing dermocosmetics brands have been leveraging the rising trend of short-video APPs such as Douyin and Kuaishou, and even popular site among Gen-Zers namely Bilibili (or B Station) which was initially famous for sharing anime and comic video content and recently went into mainstream in beauty marketing by featuring KOLs’ makeup tutorials, unboxing videos and product reviews.

Similarly, brands are usually very active on social e-commerce platforms such as RED and Weibo, which enable brands to leverage the influence of KOLs and KOCs (key opinion consumers) to build brand awareness and increase trial. Livestreaming continues to play a vital role in driving sales, and accounts for a larger portion of brand revenue in 2021. For example, sales from livestreaming takes up over 80% of Dr.Yu’s total sales.

Online marketplace has been an important channel for skincare market in Asia Pacific, while its potential will continue to be unleashed in the forecast years. It’s witnessed that most dermocosmetics brands that recorded dynamic growth in recent years have realized the importance of e-commerce and made increasing efforts in engaging with consumers through various digital marketing tactics. In this way, these dermocosmetics brands are able to break through the limitation of offline channels and reach broader consumers.

Future outlook:

Consumers in Asia Pacific are showing increasing desire for safety, efficacy and transparency and demonstrating increasing preference for brands with strong clinical and laboratory background. This would indicate strong potential for brands that can justify efficacy though a series of high-function ingredients and unique technology. Besides, online marketplace is expected to be a key battlefield for dermocosmetics brands, especially for those that aim to reach millennials and Gen-Z consumers. It’s vital for brands to adopt various digital marketing tactics to drive brand awareness and make the connection with younger generation.

Skincare market in Asia Pacific is evolving relatively quickly, with fast-changing consumer attitude and rapid new product launch, For example, “function” skincare, which usually adopts high potency ingredients with concentrated formula, is gaining increasing attention in recent years, especially among sophisticated consumers or “skintellectuals”, and could be a potential threat for brands with a dermocosmetics nature. Dermocosmetics is expected to witness fierce competition in the forecast years in Asia Pacific, momentum that beauty players in APAC can benefit from through formulation and ingredient innovation, digital marketing strategies, and developing strong consumer base.

by Kelly Tang, Consultant Euromonitor International

Kelly Tang is a Consultant at Euromonitor International, specialized in consumer health, beauty and personal care, luxury goods and apparel. She received her MA in Media Studies from Syracuse University in the U.S. Her professional background includes working in consumer research, marketing & advertising in Shanghai and New York, before joining Euromonitor Shanghai Office. The diverse and various experience has made Kelly an expert with strong market insight, enabling her to have comprehensive understanding of these markets and provide in-depth analysis on future prospect.

Kelly Tang is a Consultant at Euromonitor International, specialized in consumer health, beauty and personal care, luxury goods and apparel. She received her MA in Media Studies from Syracuse University in the U.S. Her professional background includes working in consumer research, marketing & advertising in Shanghai and New York, before joining Euromonitor Shanghai Office. The diverse and various experience has made Kelly an expert with strong market insight, enabling her to have comprehensive understanding of these markets and provide in-depth analysis on future prospect.

LinkedIn : Kelly Tang

Email : kelly.tang@euromonitor.com

Euromonitor will be doing a session at the upcoming in-cosmetics Korea talking about one of the six key COVID-19 era themes that are impacting consumer markets. Find out more about this session here.

Enjoyed this article? Get more by subscribing to our newsletter!

Feeling inspired to see ingredients and trends in action?

Then why not visit one of the in-cosmetics events around the world?