2023 is the year of India at in-cosmetics Asia and this is part of a series to shine a light on the dynamic Indian personal care market…

Nestled in the heart of South Asia, India stands as a captivating and vibrant nation, celebrated for its rich cultural heritage and extraordinary diversity.

Boasting a population of over 1.4 billion in 2023, it has surpassed China to become the world’s most populous country (1), embracing a multitude of ethnicities, languages, and cultural backgrounds.

The beauty industry in India is currently in the midst of an uprising primarily driven by its economic, social, & technological changes – see below.

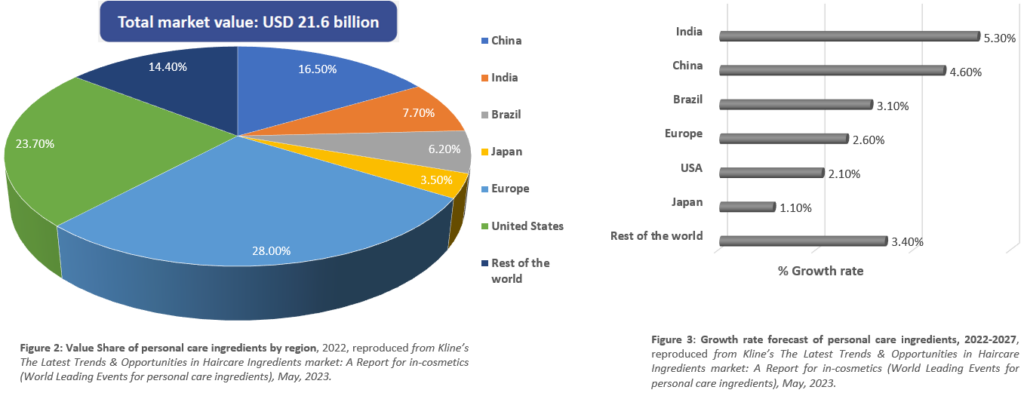

India has made remarkable strides in the cosmetic market, particularly in the personal care ingredients sector, securing a substantial 7.7% value share by region in 2022 (Figure 2 below).

As a result, it now ranks as the 4th largest market globally, trailing behind Europe, the US, and China (2).

Among its various applications, skincare holds the largest share at 53.5%, followed by haircare at 37.3%, colour cosmetics at 5.4%, sun protection at 0.3%, and other applications, including oral/DEO, at 3.4% (2).

Looking ahead, India is projected to spearhead the growth in personal care ingredients with a 5.3% increase (2022-2027) compared to the rest of the world (Figure 3).

Currently, the market is dominated by L’Oréal India, Oriflame India, Hindustan Unilever, Procter & Gamble Home Products, NIVEA India, Godrej Consumer Products, Emami, Dabur India, Marico, and Lotus Herbals.

Additionally, the beauty industry’s continued success is attributed to the thriving direct-to-consumer brands facilitated by e-commerce platforms like Flipkart, Amazon India, Myntra, and Nykaa. This flourishing trend plays a pivotal role in shaping the future of India’s beauty industry (3).

Formulating Cosmetics Targeted at Indian Consumers

Skin Diversity

The diverse spectrum of Indian consumers skin includes shades from light to dark (Type III-VI in Fitzpatrick skin grading).

Comparatively, it consists of larger pores, higher pore density with a high sebum production (4,5). Indian consumers skin faces a variety of aggressors in the environment, including UV exposure, pollution, high humidity, excessive heat, and cold requiring a repertoire to prevent skin conditions such as acne, erythema, pigmentation issues (e.g., melasma, tanning, post inflammatory pigmentation after injury (brown marks), under eye circles & pigmentation around the mouth).

Moreover, the usage of drying chemicals in soaps and the type of water (hard or soft) used, can impact the skin’s barrier function (6).

The Indian beauty market has mainly consisted of international labels until a few years ago, which meant that the dominating products were more suited to the brands’ home markets, as opposed to melanin-rich skin.

However, several homegrown and international brands are now developing product lines for south Asian consumers, recognising that its needs are different. In response to global BLM protests, cosmetics brands have altered their marketing, removing, or replacing claims related to “lightening” and “fair.”

Nevertheless, topical skin lightening/brightening remains (7), but the popularity is anticipated to subside. The emerging trend of ‘skinimalism’ – where minimalism meets skincare, focuses on embracing your skin with all its flaws and strengths. Consumers continues to invest in ethical, nature friendly products built on sustainable practices and take a holistic approach to beauty.

Hair Diversity

Genetic ancestry, regional climate, and cultural practices mould Indian hair diversity (approximately ranging from 2A-3C in traditional hair chart).

Individuals from northern regions, where the climate is often more temperate, may have hair with varying degrees of waviness or curliness, while those from the southern parts, with a tropical climate, might have hair that tends to be more coiled or curly.

Indian hair is typically finer and softer in texture and tends to have a higher density, giving it a voluminous and full appearance.

This type of hair has high porosity, meaning it can absorb & exude moisture easily. This high density also makes it more resilient to damage and breakage. It has higher level of natural oils & generally appears shiny.

Colour Significance

Colours have symbolic meaning in Indian culture. Products with colours associated with purity, prosperity, or cultural celebrations (e.g.: Mehndi, Holi, Diwali, Pongal) may attract more attention from Indian consumers. Although it can be very diverse from region to region, many customs are associated with Indians wearing coloured products (including colour cosmetics).

Fragrance Preferences

Scents hold cultural significance in India, and consumers often have specific preferences based on traditions. Understanding and incorporating popular fragrances can enhance product appeal.

Ayurvedic Focus

Ayurveda, India’s ancient system of medicine, heavily influences beauty practices. Formulating products with herbal and natural ingredients resonates with Indian consumers who value traditional remedies especially for skincare and haircare.

Ethical and Sustainable Practices

Indian consumers are increasingly conscious of environmental and ethical concerns. Brands that promote sustainability, cruelty-free practices, recycling initiatives and fair-trade sourcing (CSR) can gain favour among consumers.

Traditional Beauty Rituals

Incorporating elements of traditional beauty rituals in product formulations can appeal to consumers seeking products rooted in cultural heritage.

Packaging Designs

Thoughtful and culturally sensitive packaging with ingredient and claims transparency that reflects Indian aesthetics and values can create a deeper emotional connection with consumers.

Seasonal Adaptations

India experiences diverse climates across its regions, requiring the formulation of season-specific products that address varying skincare and haircare needs.

Regulatory Compliance

The Central Drugs Standard Control Organization (CDSCO) mainly regulate activities relating to cosmetics. In addition, consumers look for products endorsed by recognized certification bodies, especially for organic, natural, and Ayurvedic claims.

Embracing Digital Transformation

Virtual Product Testing, Active engagement with consumers on social media platforms fosters brand connection, communication, and knowledge sharing.

In conclusion, formulating cosmetics for the Indian market requires a keen understanding of the diverse skin types, climate conditions, and cultural preferences present in the South Asian region.

As the country’s beauty and personal care industry continues to evolve, a well-informed approach to formulation will undoubtedly pave the way for cosmetics that not only enhance aesthetics but also mirror the spirit of India’s vibrant beauty culture.

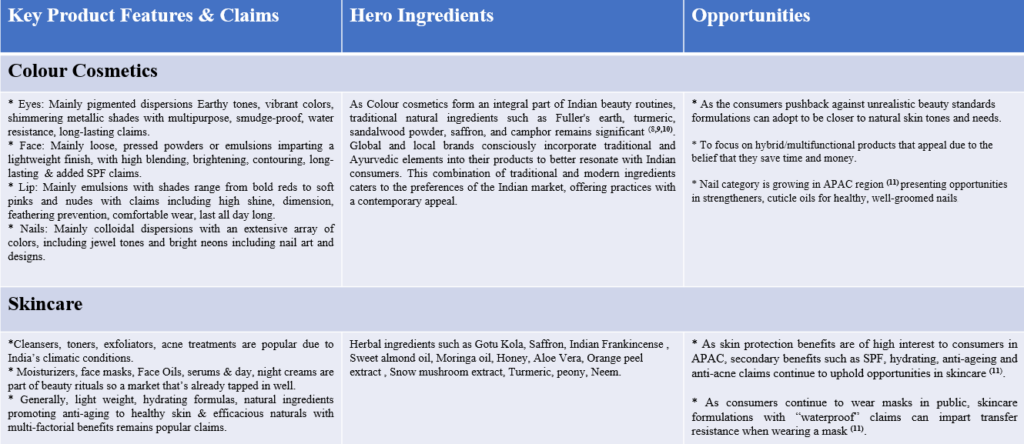

Table 1: Key product features, hero ingredients and opportunities across selected cosmetic categories.

Bibliography

1. Hertog S., Gerland P. and Wilmoth J., India overtakes China as the world’s most populous country. UNITED NATIONS Department of Economic and Social Affairs Economic Analysis. UN DESA Population Division. UN DESA Policy Brief No. 153:[Online] 04 24, 2023. [Cited: 07 30, 2023.] https://www.un.org/development/desa/dpad/publication/un-desa-policy-brief-no-153-india-overtakes-china-as-the-worlds-most-populous-country/.

2. Kline. The Latest Trends & Opprtunities in Haircare Ingredients market: A Report for in-cosmetics (World Leading Events for petrsonalcare ingredients) . s.l. : Kline, May, 2023.

3. Ro H. Sahrash M. The cosmetic industry in india- a PESTLE analysis, Perspectives on Business Management & Economics. Visakhapatnam : Viswamitra Foundation, 07-2022, Vols. VI (ISBN: 978-81-951151-0-5).

4. Flament F, Francois G, Qiu H, Ye C, Hanaya T, Batisse D, Cointereau-Chardon S, Seixas MD, Dal Belo SE, Bazin R. Facial skin pores: a multiethnic study Clin Cosmet Investig Dermatol., 2015, Vol. 8, pp. 85-93.

5. Sarkar R, Garg VK, Jain A, Agarwal D, Wagle A, Flament F, Verschoore M. A randomized study to evaluate the efficacy and effectiveness of two sunscreen formulations on Indian skin types IV and V with pigmentation irregularities. Indian J Dermatol Venereol Leprol 2019;85:160-168.

6. Voegeli D. The effect of washing and drying practices on skin barrier function. J Wound Ostomy Continence Nurs. 2008 Jan-Feb;35(1):84-90. doi: 10.1097/01.WON.0000308623.68582.d7. PMID: 18199943

7. Pollock S, Taylor S, Oyerinde O, Nurmohamed S, Dlova N, Sarkar R, Galadari H, Manela-Azulay M, Chung HS, Handog E, Kourosh AS. The dark side of skin lightening: An international collaboration and review of a public health issue affecting dermatology. Int J Womens Dermatol. 2020 Sep 17;7(2):158-164. doi: 10.1016/j.ijwd.2020.09.006. PMID: 33937483; PMCID: PMC8072511.

8. Kumar, D., Rajora, G., Parkash, O., Antil, M. and Kumar, V., 2016. Herbal cosmetics: An overview. International Journal of Advanced Scientific Research, 1(4), pp.36-41.

9. Chaudhri, S. K. and Jain, N. K. (2014) “History of cosmetics”, Asian Journal of Pharmaceutics (AJP), 3(3). doi: 10.22377/ajp.v3i3.260

10. Patkar KB. Herbal cosmetics in ancient India. Indian J Plast Surg. 2008 Oct;41(Suppl):S134-7. PMID: 20174537; PMCID: PMC2825132.

11. Mintel article, The intersection of value, sustainability and skinification in colour cosmetics, (24.07.2023)

12. Rajani T., Bar soap reigns in India’s cleansing market; body wash struggles to lather up, MINTEL (Online 23, 04, 2023) [Cited: 04 08, 2023]

13. Kedar N., 4 hair trends to watch out for in 2023, according to experts (17.02.2023)

14.Rajani T. , Breaking through Barriers : Boosting body wash usage in India (25.05.2023)

15. Mintel Announces the Key Trends That Are Shaping the Indian Consumer Market, Business wire India (22.03.2022),

16. India oblivious to sun safety: 65% of consumers don’t use sunscreen, Mintel article (01.08.2019).

17. Donglikar M.M. and Laxman D.S., Sunscreens: A review, Pharmacognosy Journals, January 2016, Volume 8, Issue 3,

Enjoyed this article? Get more by subscribing to our newsletter!

Feeling inspired to see ingredients and trends in action?

Then why not visit one of the in-cosmetics events around the world?