In the realm of beauty trends, the ‘2024 Opensurvey report’ in South Korea sheds light on the skincare and makeup routines of Korean consumers.

On average, consumers use approximately 5.99 skincare products, with a significant portion opting for four or more products simultaneously. This underscores the meticulous attention given to skincare routines, with combinations ranging from basic toner and cream usage to more elaborate regimes involving mist, essence/serum/ampoule, and face oil/lotion/emulsion.

Similarly, makeup routines also demonstrate diversity, with an average of 5.96 products being used per person. While basic routines may consist of cushion and lipstick, more comprehensive approaches encompass various base products like makeup base, foundation, along with an array of lip products.

In terms of product selection criteria, effectiveness and texture emerge as paramount considerations for both skincare and makeup products. Additionally, factors such as price-value ratio and positive online reviews hold significance. Interestingly, brand recognition and values appear to hold lesser weight compared to product efficacy, texture, price, and online reviews.

These recent trends of Korean consumer behaviours seem to have an impact on the 2024 K-Beauty market trends as introduced below from ‘THE mighty’ brick-and-mortar dinosaur OliveYoung and up-and-coming e-commerce Beauty platform BeautyKurly;

Boundless Beauty:

As we step into 2024, the concept of “boundless beauty” takes centre stage, transcending traditional boundaries between beauty and health. Consumers are seeking products that not only enhance their appearance but also contribute to their overall well-being. OliveYoung’s introduction of the “Health+” category within its application underscores this trend, catering to individual concerns with a curated selection of health supplements and inner beauty products.

그림 1. OliveYoung Apps page with Health+ category, Oliveyoung website (2024)

Omni Channel Experience

The omnichannel experience continues to redefine the retail landscape, emphasizing seamless integration between offline and online platforms.

Brick-and-mortar stores are no longer mere sales outlets but serve as communication hubs, offering immersive experiences and storytelling to engage consumers on a deeper level.

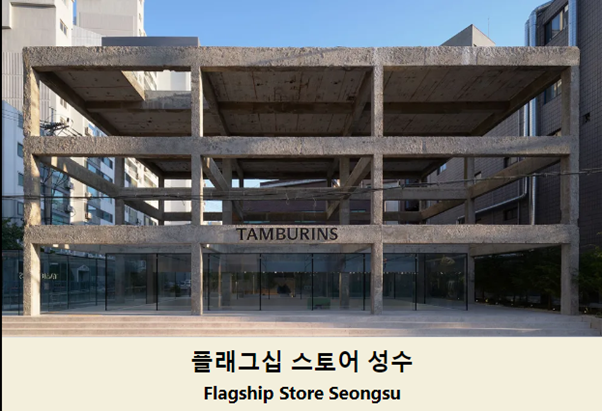

A brand like TAMBURINS exemplifies this approach, with flagship stores in Seoul attracting both domestic consumers and international tourists seeking unique, experiential shopping destinations.

TAMBURINS is a fragrance & skincare specialty brand, and they have opened flagship stores in Sinsa-dong since the launch of the brand in 2017.

Since then, they have opened flagship stores in Samcheong, Dosan, and Hannam, and these stores are not meant for sale but are recognizing cosmetics as content and appealing to consumers with a new approach.

In addition, each store introduces a different concept and store design, and at the same time presents a variety of pop-up stores and exhibitions for each season, making it an essential visit for not only domestic consumers but also foreign tourists.

그림 2. TAMBURINS flagship store in Seongsu, namuwiki

Teenager Beauty

The influence of teenagers in the makeup category cannot be overstated. Brands are increasingly tailoring their offerings to resonate with the preferences of this demographic, leveraging social media and pop culture to capture their attention.

From vibrant colour palettes to cruelty-free formulations, brands like Dasique and Etude House are setting the pace for innovation and inclusivity in the beauty industry.

Dasique, a brand that specializes in make-up products, is gaining enthusiastic popularity not only in Korea but also in the MZ generation, including teenagers in Japan.

In particular, by maximizing colour variation, which can be somewhat limited, dozens of options are introduced for each colour line, while also adding cool and warm tone segments separately, which are not common for make-up brands, but also has elements that appeal to the MZ generation at home and abroad.

In addition, Etude House and Espoir, which have already been proven to be competitive by consumers of the MZ generation in Korea, China, and Japan, are preparing to aggressively target overseas markets through new lines that have re-established new designs, packaging, and concepts based on Hallyu and K-Beauty content, solidifying dominance in the domestic market.

그림 3. Dasique product page at OliveYoung website (2024)

그림 4. Etude House product page at OliveYoung website (2024)

그림 5. Espoir product page at OliveYoung website (2024)

Conscious Beauty

The rise of conscious beauty reflects a shift towards sustainability, ethics, and transparency in the cosmetics industry.

Leading brands like Amore Pacific are championing this movement, enforcing strict compliance across all brands and fostering a culture of accountability.

With a growing emphasis on eco-friendly practices and community engagement, conscious beauty is no longer just a trend but a guiding principle driving industry standards.

Along the way, AmorePacific is typically strengthening sustainability governance for individual brands, such as by publishing “2023 Sulwhasoo Sustainability Report” published last April for the first time as an individual brand in Korea apart from AmorePacific Sustainability Report since 2016.

그림 6. Sulwhasoo Sustainable Report Cover, AmorePacific (2024)

Men’s Grooming

Men’s grooming is experiencing a renaissance, fuelled by a desire for self-care and personal expression.

Perhaps not many people know that the Korean male cosmetics market was the largest market in the world until a few years ago.

Although the rapid growth of the Chinese men’s beauty market is now receiving more attention, the Korean market is still an innovative market for men’s beauty.

Korean brands like Dr.G are leading the charge with derma-inspired products that simplify skincare routines without compromising effectiveness.

From multifunctional all-in-one formulations to targeted solutions for specific concerns, the men’s grooming market continues to expand, challenging stereotypes and redefining conventional notions of masculinity.

그림 7. Dr.G Men’s product page at OliveYoung website (2024)

Luxury Market Emphasis on Customer Experience

In the luxury beauty market, customer experience takes precedence, with brands prioritizing personalized service, exclusivity, and immersive experiences to enforce brand loyalty and appearance.

This change is also seen in the recent move of Sulwhasoo, Korea’s leading luxury brand. In order to become a K-Beauty Hip icon from the romance of Korea’s representative ‘Ajumma’, the brand model was also replaced by Rose of Black Pink, a K-pop idol, and the entire six-story building in Dosan Park was renovated into a flagship store, allowing everyone who comes to the store to ‘see, feel, taste, and enjoy’ Sulwhasoo depending on the purpose of each floor.

그림 8. Sulwhasoo flagship store at Dosan, Womentimes

그림 9. The House of Sulwhasoo Bukchon, Market Economy Journal

Professional Home Care

The normalization of homecare routines is observed, with consumers increasingly incorporating professional-grade skincare treatments and devices into their daily regimens.

Lagom is a brand created by Kowon, one of Korea’s most sought after celebrity makeup artists, Lagom delivers an advance take on skin hydration. Interesting feature of the brand is a philosophy that great make-up comes from great cleansing which Lagom’s special and effective cleansers are best sellers within the brand.

FOBO (Fear of Better Option)

Information overload is driving a fear of missing out on the best products and experiences. OliveYoung are leveraging consumer feedback and big data analytics to stay ahead of trends, curating product selections that resonate with discerning shoppers. Transparency and authenticity are paramount as consumers rely on peer reviews and recommendations to make informed purchasing decisions.

Early (anti-ageing)Care Syndrome

There’s a growing trend of starting anti-ageing skin care routines with consumers coming more proactive in addressing skincare concerns early on in life.

In particular, COSRX, which has recently attracted more attention in overseas markets than in Korea, is introducing its snail mucus filtrate product line through Olive Young, which has been used by Korean consumers for a very long time, now attracting youngsters’ attention as a product that can manage skin elasticity and moisture without resistance.

In conclusion, the 2024 beauty trends in the Korean cosmetics market reflect a dynamic blend of innovation, inclusivity, and sustainability.

For K-Beauty growth, Brick-and-mortar stores like OliveYoung serve as incubators of creativity and community, driving the industry forward with experiential retail concepts and consumer-centric initiatives.

As we navigate the ever-changing landscape of K-Beauty, one thing remains clear: the future of cosmetics is boundless, promising new horizons of possibility and potential for all.

Feeling inspired?

Then why not visit one of the in-cosmetics events around the world?