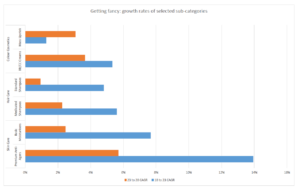

Buoyed by rising disposable incomes and discretionary spending approaching the levels similar to those enjoyed by their Western counterparts, Eastern European beauty and personal care industry managed steady gains over the last few years. The pandemic, the geopolitical shocks and the consequent inflation surge – none of them managed to derail continuous expansion of sales. This has not, however, meant a slow and steady development of the industry. Even the exorbitant price increases did not stop consumers from moving towards more sophisticated products. Be it high-tech formulations, premium ingredients, sustainability claims on packaging or anything else, increasingly well-educated shoppers continue spending lavishly on pricier items. Interestingly, this has not turned the industry into the realm of foreign multinationals despite their seemingly limitless R&D and marketing budgets. Being close to the client and by localising their brands as much as possible, local manufacturers continue maintaining and even increasing their market positions. Driving the market, skin care in particular has performed exceptionally well, registering an annual average growth rate of 7% (measured in current Eur terms) over the period 2018 to 2023. At the same time, basic categories remain stagnant, facing not just market maturation issues but also ever-expanding private label offerings.

Just as consumers gravitate towards more sophisticated products that deliver fat profit margins, brand owners have never been busier. Historically, the industry has relied on new product launches to keep consumers interested. Encouraged by previous success as well as emerging online distribution opportunities, companies ramped up their new product development activities as of late, making the best-performing categories also the most crowded. For example, moisturisers and treatments – the holly grail of the industry of late – has seen 148 new brands and sub-brands launched online since March 2021 in Czech Republic alone, according to Euromonitor International Passport Innovation system. This makes it by far the most innovative category, followed by body care with 95 launches. The deluge of new launches will put what seems thus far unsatiable appetite for novelties by Eastern Europe beauty shoppers to the test with some products inevitably set to fail.

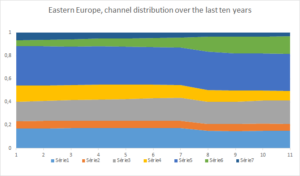

Another important shift has happened in the distribution of beauty and personal care goods. Having already grown dynamically, e-commerce was turbocharged by pandemic-induced lockdowns. Interestingly, for a channel that is supposed to lead to a borderless world, internet retailing in Eastern Europe displays strong national and regional characteristics, defying the looming threat of platforms like Amazon or emerging Chinese sellers. Czech Republic’s Notino is the biggest success story with Polish Allegro marketplace also appreciated by consumers for the easiness of use, speedy deliveries and a product mix tailored to local preferences.

The emergence of e-commerce as a viable sales channel could not come at a better time for some local producers. Privately brand owners confide that dominant positions by market leaders within specific offline channels leave them at the mercy of retailers during negotiations, especially in Poland and Slovakia. This affects everything from profit margins to introduction of new products with retailers effectively acting as gatekeepers deciding if a certain new launch is given a chance or not. Going forward, more viable distribution options online is set to reduce brand owner’s dependence on good graces of self-owners, benefiting consumers.

By the end of 2028 the market will look quite dissimilar to the one observed today. Despite facing economic headwinds and continuation of inflationary pressures, industry is expected to continue on the path of sophistication and, by extension, growth. Geographically, the biggest growth markets will be Poland and Romania, adding EUR885 million and EUR492 million respectively which all but guarantees them to be in the crosshairs of companies planning expansion. Other markets of the region will also inch up, with average annual constant growth rates between 1% to 6%, driven by insatiable consumer appetite for novelties and experimentation.

ABOUT EUROMONITOR INTERNATIONAL

Euromonitor International is the world’s leading provider of global business intelligence, market analysis and consumer insights. From local to global and tactical to strategic, our research solutions support decisions on how, where and when to grow your business. With offices around the world, analysts in over 100 countries, the latest data science techniques and market research on every key trend and driver, we help you make sense of global markets.

Enjoyed this article? Get more by subscribing to our newsletter!

Feeling inspired to see ingredients and trends in action?

Then why not visit one of the in-cosmetics events around the world?