Like most consumer goods industries, beauty & personal care has experienced a volatile period in recent years and 2022 was no different. Inflation seeped across the globe as the pandemic eased, with a surge in demand for consumers goods impacted by sourcing and supply chain problems.

However, this did not deter consumer spending of beauty & personal care products globally in 2022, particularly hair care, which witnessed strong single-digit growth in value terms.

Less Is More

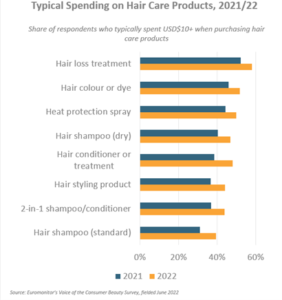

As unit prices rose, consumers have become more selective with their hair care purchases opting for fewer but higher quality items. Euromonitor International’s Voice of the Consumer: Beauty and Personal Care 2022 Survey, which was fielded in June 2022, found that typical spend per one product over USD$10 in 2022 was significantly higher across all subcategories when compared to 2021.

This can be partly attributed to increased penetration of hair treatments, such as scalp care and hair loss products, which often come at a higher price point, becoming more popular among consumers. Additionally, with the return of normal life, along with a desire for consumers to spend more on products as a treat for living in lockdown for two years, demand for premium presentations continued to grow.

Higher product prices have also contributed to the acceleration of consumers adopting a back-to-basics approach, with hair care routines being stripped back and demand for products with attributes such as high efficacy and multifunctionality growing in popularity.

Presentations supported by science-backed claims are at the forefront of consumers’ baskets as economic uncertainty has left customers with less financial leeway to try products that they have not used previously, so products with proven results are being trusted. With price rises continuing into 2023, weaker consumer confidence is expected to further propel this streamlined approach consumers are taking to hair care.

Skinification Of Hair

Slimmed down routines has resulted in consumers investing more in products that contain the features they desire most. One sought after area has become scalp health, which started to rise in prominence during COVID-19 lockdowns, as the emergence of “skintellectuals”, who strived to better understand their skin and beauty needs.

This has naturally expanded and entered the hair care space, driven by SKUs positioned for scalp health and the microbiome. Demand has been particularly prevalent among Gen Zs and Millennials, who are looking to protect and maintain healthy hair from a younger age thanks to stronger understanding and knowledge of hair health compared to previous generations.

Euromonitor’s VIA platform, a global SKU database that tracks areas such as pricing, ingredients, and claims, found that the number of hair care products with skin health attributes – such as hydration and hypoallergenic – has increased by around 30% between 2020 and 2022.

This has been driven by more SKUs being formulated with ingredients such as hyaluronic acid, niacinamide and salicylic acid owing to their skin benefits. Recent acquisitions suggests that activity in the hair skinification space will only intensify. Examples include Puig acquiring a majority stake in Kama Ayurveda in September 2022, while Unilever Ventures invested USD$2 million into Australian scalp care start-up Straand in January 2023 to fuel global expansion.

Download Euromonitor’s report on the Transformation of Hair Care in a Post-pandemic World to find further insights and stay ahead of the curve in the industry.