As we explore haircare in the Asia Pacific region, our Indonesia expert puts the spotlight on Indonesia…

Indonesia Outlook for Haircare

As a science that studies how to care for hair and scalp, to choose cosmetics according to hair type, climate and treatment techniques, the sector’s beauty experts recommend ways to treat hair, which are grouped into (1) daily haircare by washing hair using shampoo, conditioner, and dry treatment, (2) periodic care with cream baths and masks, (3) Special treatment for hair after straightening (keratin).

In response to hair problems and current trends, Indonesian salon services are proliferating and focusing, starting from basic treatments such as haircuts, cream baths, hair masks, and hair colouring to straightening and extensions.

The increasing variety of salon services and professional products for haircare in Indonesia is predicted to drive the market until 2028. However, the high price of services and haircare products is a major issue in this industry.

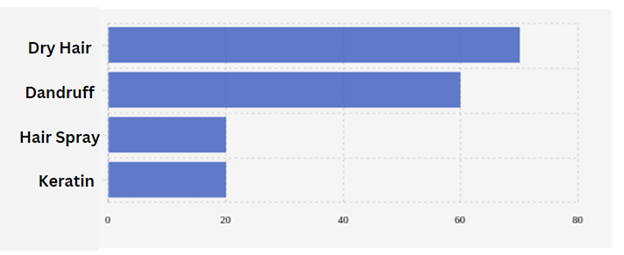

As is the case globally, more and more Indonesian consumers are learning how to take care of their hair with online tutorials and the help of influencers. Google noted a surge in searches for haircare activities throughout 2022.

‘Dry hair’ ranks first with an increase of up to 70% vs last year on YouTube. Second, you’ll find ‘dandruff’ with a 60% increase on YouTube, too followed by ‘hair spray’ (+20% year on year) on Google. Fourth was keratin with a 20% rise on Google.

Haircare Search Trends on Google and YouTube to Rise in 2022, What to Look Out for? (Katadata, 2022)

2023 Haircare Developments in Indonesia

The Indonesian haircare market is experiencing remarkable growth, a phenomenon driven by increasing consumer awareness and spending on personal grooming products.

Rising significantly is the number of haircare products ranging from traditional herbal-based treatments to more technologically advanced products. Examples range from old school aloe vera plant to get its benefit but nowadays consumers tend to look for some technology including encapsulated aloe vera.

In general, consumers in Indonesia are more ingredient-aware and are seeking organic alternatives. Companies are responding by launching new product lines made from natural ingredients which include aloe vera, coconut oil, and other plant-based ingredients.

A company that tends to launch new products using natural ingredients is PT. Gondowangi Traditional Kosmetika, who are famous for their natural haircare products.

Source: https://gondowangi.com/natur/

As technology improves, many brands are offering personalized haircare solutions based on a customer’s specific hair type and requirements such as dandruff solutions due to scalp irritation. This allows customers to find the right products that work best for their hair and leads to customer satisfaction.

The online retail market in Indonesia is growing rapidly. According to McKinsey, in 2021, it became the ninth-largest e-commerce sector in the world, valued at $43 billion, with many brands capitalising on the trend.

Companies operating in the Indonesia haircare industry are investing more in research and development to create innovative products that meet the evolving choices of consumers such as anti-pollution product for hair, scalp special treatment for man etc.

This includes the development of new ingredients such as frangipani flower extract, mangosteen extract and even vitamin C, ceramide and technology to make haircare products more effective.

With a growing population, many haircare brands are expanding their operations into rural areas in Indonesia to reach a wide customer base.

According to Statista Market Forecast1, the revenue in the haircare market in Indonesia amounts to US$1bn in 2023 and is expected to grow annually by 4.10% (CAGR 2023-2028).

Increasing product awareness, financial independence among female consumers, and considerable attention to male grooming are the main drivers of this expected growth because of the male population’s concern about their appearance and interest in cosmetics.

In addition to that, digital penetration (currently standing at 73.7% in Indonesia) has also increased rapidly, which in turn improves the e-commerce infrastructure, making haircare products more accessible to consumers.

The following are leading haircare companies in Indonesia with the most sales both in the marketplace and e-commerce:

L’Oréal

Present in Indonesia since 1979, the French behemoth has always demonstrated its commitment to the growth of the beauty industry focused on innovation, digitalization, education, and human resources. Based on the report from the Databooks Katadata official website, L’Oréal saw revenues of US$ 40,310 billion in 2022.

Source: https://www.loreal-paris.co.id/elviverecycle

Makarizo

This brand claims it can overcome various kinds of hair problems almost as a “trend centre” for haircare products. The future looks bright for Makarizo with more intensive promotions and additional product innovations tailored to the market such as natural based ingredients, digital trending and hair treatment tutorials.

Source: https://akashainternational.com/id_ID/makarizo-hair-energy/

Source: https://akashainternational.com/id_ID/makarizo-hair-energy/

Pantene

Pantene has been around for decades and it dominates the Indonesian market and is produced by PT P&G Indonesia, which has been marketed in Europe since 1947. Since its first marketed product, Pantene has continued to innovate to meet its customers’ needs and wants, especially those related to haircare.

As reported on the Compas official website in 2022, Pantene was ranked third as the best-selling shampoo product brand in Indonesia during the second quarter of 2022, and there were approximately 32.3 thousand transactions of Pantene products in one quarter only from its sales at

Source: https://www.pantene.co.id/id-id/produk-toko/rangkaian-produk/total-damage-care

Haircare Opportunities in Indonesia

Hair Growth Treatment

In Indonesia, where beauty and personal care are highly valued, hair growth treatments will always be a popular claim sought by consumers, including combating hair thinning and promoting hair regrowth and proven effective.

Numerous brands offer shampoos and hair tonic infused with essential oils, vitamins, or natural extracts that claim to promote hair growth and reduce hair loss.

Source: Miranda Hair Growth Formula Shampoo, with Sunflower oil and biotin to help hair growth and reduce hair loss

Gently Hair Serum is infused with candlenut oil and ginseng extract, which are known to nourish and thicken the hair, stimulate hair growth, increase hair density, promote healthy and non-dry hair, and strengthen hair roots and strands.

It is formulated specially for baby and kids.

ERHAIR Hairgrow Serum is a hair serum that tackles hair loss and helps stimulate new hair growth by using its Kopexil and Panax Ginseng extracts.

These work together to reduce hair loss and promote hair regeneration by improving blood circulation and nourishing the hair.

Hair Straightening

Indonesia is one of the most ethnically diverse societies on earth as it consists of 1,300 ethnic groups, each having distinct hair types. As a result, hair types in Indonesia can vary widely, however wavy and curly hair are the most common hair types in Indonesia.

Therefore, the pursuit of sleek and straight hair has led to a surge in the popularity of hair straightener treatment products within the country. A semi-permanent treatment has become a game-changer for individuals seeking long-lasting straight hairstyles. #Easystraight Hair Energy from Makarizo has created an easy to use hair straightening cream which provides a solution for straight, neat, and permanent hair without having to go to a salon.

#Easystraight Hair Energy from Makarizo has created an easy to use hair straightening cream which provides a solution for straight, neat, and permanent hair without having to go to a salon.

Haircare for the Hijab-Wearing Market

The report by The Royal Islamic Strategic Studies Centre (RISSC) in 2023 indicates that the Muslim population in Indonesia has reached 237.55 million people, making it the largest in the Association of Southeast Asian Nations (ASEAN) region as well as globally.

The Muslim population in Indonesia accounts for 86.7% of the total, hence the booming segment of hijab-wearing women who face unique challenges including dryness, breakage and scalp issues.

Shampoo products especially created for hijab—wearing consumers (Sariayu and Pantene).

Ideal Haircare for the Indonesia Market

As Indonesia has a tropical climate with humidity usually between 70 and 90%, it’s crucial to prioritize clean hair. Because of that, it is recommended to cleanse one’s hair with a gentle, sulfate-free shampoo to remove dirt and pollutants. Hydrate hair with a moisturizing conditioner and treat it with deep conditioning treatments to combat dryness caused by humidity and minimize heat styling.

The Market is Shifting

The distribution channels for haircare products in Indonesia is split mainly between supermarkets/hypermarkets, specialty stores and online stores. Supermarkets/hypermarkets hold the largest market share, comprising approximately 40% of the total distribution channel.

Globally, Asia-Pacific emerges as the leading haircare market with a 40% share. This dominance can be attributed to factors such as the region’s substantial population, rising disposable incomes, and rapid urbanization.

The market landscape has undergone a significant transformation as offline stores have gradually given way to online shopping. This shift has been driven by the convenience and accessibility offered by e-commerce platforms for purchasing haircare products.

As a result, the online haircare market has witnessed substantial growth, prompting brands and retailers to establish robust digital platforms and expand their product offerings.

While offline stores still hold significance, the online shopping trend is expected to continue shaping the haircare market, providing consumers with convenience, variety, and a seamless shopping experience in the digital realm.

Conclusion

Indonesia’s haircare industry is on a path of continuous growth and evolution. The market offers a diverse range of products, from natural and sustainable solutions to personalized haircare.

Digital platforms, especially social media and e-commerce, play a crucial role in shaping consumer behaviour and introducing new trends.

Additionally, the demand for halal-certified products presents a significant opportunity for brands.

By staying up to date with consumer trends and focusing on innovation, the haircare industry in Indonesia is set to flourish for years to come.

Find out more about haircare at in-cosmetics Asia on 7-9 November, with Love is in the Hair, spotlighting formulated haircare ingredients.

Enjoyed this article? Get more by subscribing to our newsletter!

Feeling inspired to see ingredients and trends in action?

Then why not visit one of the in-cosmetics events around the world?