With its sprawling archipelago of over 17,000 islands, not only is Indonesia a diverse tapestry of cultures but it is also home to a dynamic demographic landscape.

Boasting a population surpassing 270 million, Indonesia stands as the fourth most populous nation in the world, representing about 3.45% of the global total.

According to UNICEF, children make up a full third of Indonesia’s population, totalling approximately 80 million individuals, which also positions Indonesia as the world’s fourth-largest child population.

As such, Indonesia consistently witnesses a growing demand for mom and baby care products across the archipelago. Indonesia’s demographic prominence underscores its significant role on the world stage and the saturation of its baby and child market presents a ripe opportunity for mom and baby care businesses in the country.

Mom and Baby Products Generates Money

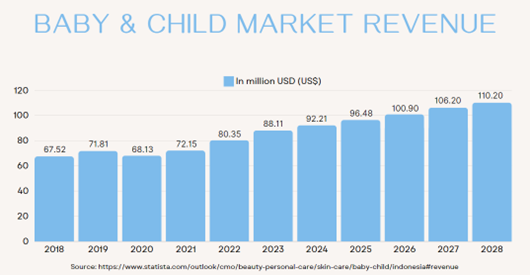

In 2023, Indonesia’s Baby & Child market exhibited noteworthy dynamics, generating a substantial revenue of US$88.11 million.

Projections suggest a promising trajectory with an anticipated annual growth rate of 4.58% (CAGR 2023-2028), reflecting a robust and expanding market.

While Indonesia’s market holds its ground, a global comparison points to China’s dominance as it leads with a staggering revenue of US$623 million in the same year. On a per-person basis, Indonesia contributed US$0.32 to this market in 2023, signifying a measurable economic impact.

This financial landscape is not only driven by conventional products but also influenced by evolving consumer preferences.

Notably, there is a discernible surge in the demand for organic baby food products within Indonesia, propelled by a rising tide of health-consciousness among parents.

Notably, there is a discernible surge in the demand for organic baby food products within Indonesia, propelled by a rising tide of health-consciousness among parents.

This trend aligns with the broader global shift toward organic and sustainable choices, shaping the landscape of the Baby & Child market in Indonesia and highlighting the changing preferences of the nation’s parents, as reported by statista.com.

As parental consciousness regarding health and hygiene continues to grow, the Indonesian market presents significant opportunities for imported baby products.

The period spanning 2014 to 2018 witnessed an impressive annual increase of 8% in the retail sales of baby and maternity products.

Fuelled by a rising purchasing power, the trajectory suggests a promising outlook for Indonesia’s baby and maternity market in the years to come.

Mom and Baby Care Now

As Indonesia experiences a steady increase in childbirth rates, the landscape of baby care products has transformed into a captivating arena for both well-established and emerging brands alike.

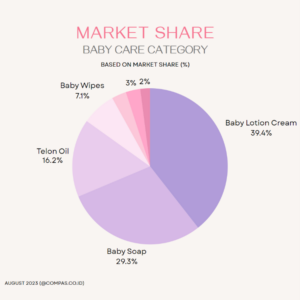

Within this dynamic market, baby lotion cream reigns supreme, accounting for a commanding 39.4% share, closely followed by baby soap and telon oil.

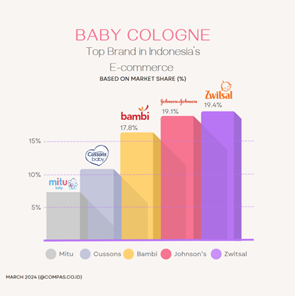

Leading the charge are globally recognized brands such as Zwitsal, Johnson & Johnson, Mitu, and Buds, all making significant strides in Indonesia’s domestic baby care sector.

Yet, it’s not just the international players shaping the market; local Indonesian brands like Bambi, Cussons Baby, Moell, and Gently have emerged as pivotal contributors, each offering their unique touch to meet the diverse needs of parents.

Yet, it’s not just the international players shaping the market; local Indonesian brands like Bambi, Cussons Baby, Moell, and Gently have emerged as pivotal contributors, each offering their unique touch to meet the diverse needs of parents.

Adding to the vibrant mix, local favourites like My Baby Telon Oil Plus Eucalyptus Longer Protection, MS Glow Kids Daily Baby Cream, and Lactacyd Baby Gentle Care have garnered considerable attention and loyalty.

Adding to the vibrant mix, local favourites like My Baby Telon Oil Plus Eucalyptus Longer Protection, MS Glow Kids Daily Baby Cream, and Lactacyd Baby Gentle Care have garnered considerable attention and loyalty.

As one of the OEM manufacturers in Indonesia, PT. Etercon Pharma, plays a significant role by producing mom and baby care products under the brand name Pure Baby. These companies, alongside the global players, have earned recognition for their extensive experience in catering to mothers, providing a diverse range of baby care products tailored to various needs.

According to a survey conducted by JakPat (focusing on Indonesian consumers) on 12 September 2022, Cussons Baby has emerged as the favourite baby care brand, securing a remarkable 40.6% approval from 910 respondents.

Following closely is Zwitsal, chosen by 36.7% of respondents, trailed by My Baby and Johnson’s. This data emphasizes the strong brand loyalty and consumer trust that these established names, both global and local, command in the Indonesian market.

Mom and Baby Demand Now

The Baby & Child segment includes products designed for the young and for the protection of their skin. These incorporate baby lotion, baby oil, baby powder and sunscreen for babies and children. Excluded are skincare products for adults, e.g. sunscreen.

In Indonesia, an increasing number of mothers exhibit a willingness to overlook higher prices when purchasing baby care products for their children. They prioritize the well-being and comfort of their little ones over cost considerations, seeking high-quality products that meet the highest safety and health standards.

This phenomenon illustrates parents’ commitment to providing the best for their precious ones, regardless of the potentially higher costs associated with premium baby care items.

Such an attitude reflects shifting values and priorities among modern mothers who go for quality and innovation in caring for their children, contributing to the growth of the baby care product market in Indonesia.

Indonesian mothers are increasingly discerning when it comes to selecting baby care products, emphasizing a strong preference for natural, eco-friendly, and ethically sourced options.

The demand extends to products that undergo dermatological testing, ensuring safety for delicate infant skin. Additionally, the surge in awareness about environmental impact has led to a growing inclination towards vegan and cruelty-free products among Indonesian moms.

These conscientious choices align with a cultural ethos that values harmony with nature and a commitment to ethical practices.

Feeling inspired?

Then why not visit one of the in-cosmetics events around the world?