An ageing population

Ageing populations across the globe harness incredible purchasing power, meaning opportunities to tap into this sector of the beauty and personal care industry (with the right approach) are vast. The global anti-ageing cosmetics market is expected to reach 60.26 billion USD by 2026, according to a report by Fortune Business Insights. Further to this, the APAC region is expected to hold the largest share of this market due to its significantly older population. Half of Japan’s population will be over 50 by 2025, according to Euromonitor International. Increased consumer awareness, plus the growing use of beauty products to prevent premature signs of ageing by younger and middle-aged generations in countries such as South Korea, China and Japan, will likely boost further growth in this market.

An ignored generation

For decades, if not centuries, a lack of age diversity and inclusion has been an issue in both R&D and marketing. Research by L’Oréal Paris revealed 40% of women over the age of 50 ‘don’t feel seen’, while Mintel’s “Diversity in Beauty” report from November 2019 stated that 26% of British consumers said ‘not catering for my age group’ is the most likely reason for them to be discouraged from using a beauty or grooming brand. For women aged 45 to 64, that rose to 35%, and 41% of women age 65+.

“I guess my biggest frustration and why I started my YouTube channel at the age of 53 is because there was literally nobody speaking to my generation,” commented YouTube star, Nadine Baggott, to Harpers Bazaar earlier this year. According to the magazine, views of cosmetics videos with ‘over 50’ in the title increased by more than 100% in 2019.

For brands that can figure out how to engage with Generation X, there is huge potential. “A few disruptive brands have seen the potential of this space. U.S.-based Pause Well-Aging offers a portfolio to tackle menopausal skin concerns: a Fascia Stimulating Tool to improve elasticity and minimize sagging, Hot Flash Cooling Mist and Collagen Boosting Moisturizer, for example. In the U.K., Boots No7 has done a similar job, in designing huge campaigns specifically for Gen X, focused on their inner beauty as well as their outer beauty” commented Jenni Middleton, Director of Beauty at trend forecaster, WGSN.

As a result, women over 45 are no longer the lost or neglected generation with more and more brands speaking directly to this sector of the population. And they’re wildly successful. For example, PRAI – Marks and Spencer’s best-selling beauty brand – has seen online sales over lockdown soar by 200% compared year-on-year, with PRAI’s Ageless Throat & Décolletage Crème selling every 60 seconds. The affordable elixir smooths throat and décolletage skin and is designed to unveil a visibly firmer appearance. And then there’s beauty expert, Sonsoles Gonzalez, who launched her Better Not Younger brand last year. “Nobody is talking to these women” she commented, “ I knew that most briefs were targeting women aged 18-44, and it was even a little joke inside [the industry]: what happens to women when they’re 45? They disappear.”

Mature Beauty: Time for change

Along with demographic changes, anti-ageing rhetoric has become age embracing. In August 2017, women’s magazine, Allure, announced that it would no longer use the term ‘anti-ageing’. “Whether we know it or not, we’re subtly reinforcing the message that ageing is a condition we need to battle… together we can start to change the conversation and celebrate beauty in all ages” commented Michelle Lee, Allure’s Editor-in-Chief.

This viewpoint was backed up by the Royal Society for Public Health who called for an end to the use of the term anti-ageing in the cosmetics and beauty industries as its report showed that ageism has a “major impact on the public’s health”. Indeed, the report found that half of the women and a quarter of men polled said they feel pressured to stay looking young.

Perhaps one of the earliest brands to champion this new way of thinking was Dove which launched its ground-breaking Campaign for Real Beauty in 2005. The marketing initiative exposed the lack of diversity in advertising and forced women around the world to question their notions of beauty. Two years later, it launched its Pro-Age range for mature skin in its belief that “beauty has no age limit”. And although many may argue such product ranges are still providing anti-ageing benefits, a flurry of other brands also rebranded their anti-ageing ranges with positive or neutral connotations such as L’Oreal Paris’ Age Perfect and NIA’s Tech Neck Line Smoother.

Alongside the products, representation of mature beauty ambassadors in the industry has improved too. Arguably one of the most recognisable faces leading this movement, actress Helen Mirren, signed with L’Oreal Paris in 2014 when was 69. And Isabella Rossellini, who was fired by Lancôme a few days after her 40th birthday as she was deemed “too old” to be the face of a beauty brand, was rehired just two years ago at the age of 63. And then there’s Bo Gilbert, who at the age of 100 featured in Vogue Magazine as the face of Harvey Nichols’ award-winning campaign in 2016.

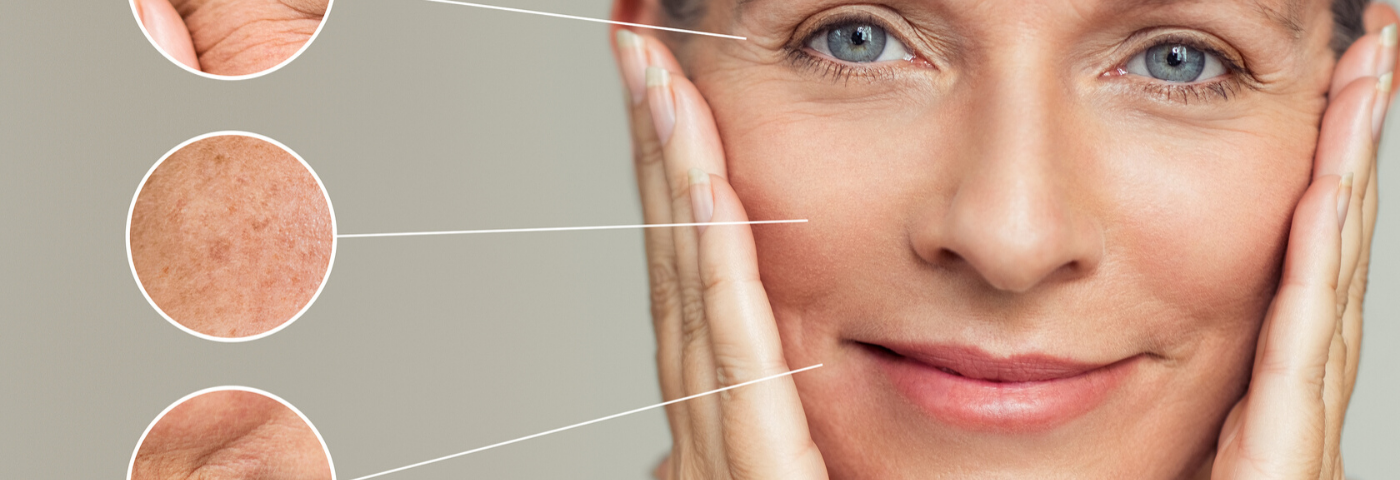

Targeted mature beauty & skincare products

As the industry embraces the beauty of all ages, increasingly avoiding the term ‘anti-ageing’, many brands are now beginning to address and target specific concerns. “We are seeing a higher number of products that target a very specific concern, as opposed to general ‘anti-ageing’ ones” commented Newby Hands, Beauty Director of Net-a-porter. “The focus is now not on age, but specific individual concerns, whether that is pigmentation or dullness. That means women really can build a more personalised wardrobe of products that they use as and when needed, rather than sticking to the same regimen day in and day out.”

Further to this, new standards governing what it means to be beautiful and to age mean the conversation has shifted from “ageing to longevity, moving beyond outward appearance to emotional and mental health[1]. A study carried out by Boots No7 Laboratories looking into the definition of beauty revealed that older women aged 39 – 53 believe what’s inside to be vital. Of the group surveyed, 80% said it was really important for them to be considered a ‘beautiful person’ on the inside as well as the outside. Backing up other research, 67% also expressed a belief that women in their 40s and 50s have been “overlooked for too long”. Dr Mike Bell, No7 Skincare Scientific Advisor for Boots No7 Laboratories, commented: ”Our definition of beauty changes as we get older – what was considered beautiful in our 20s may not be the same as our 40s and Gen X women are empowered by their age; to them, it is a symbol of the knowledge, experience and confidence they have accumulated.”

Ingredient innovations

As a result, cosmetic and personal care suppliers are increasingly helping beauty brands by focusing on ingredients that respond to the specific concerns raised by this consumer age group. in-cosmetics Asia exhibitor, Biocosmethic, for example, will showcase its Gastrodica elata root extract, OXILATA®, at this year’s show. The multifunctional antioxidant ingredient, which is inspired by Traditional Chinese Medicine, preserves microcirculation and detoxifies the skin. Skin microcirculation is responsible for essential tasks such as nourishing cells and eliminating toxins while stimulating cell renewal, which s crucial for maintaining skin architecture. Thanks to its action on endothelial cells, OXILATA® offers a new innovative approach in the anti-ageing field. It fights against premature ageing and preserves skin architecture through deep detoxification.

Fellow in-cosmetics Asia exhibitor, Lipotrue will showcase its Æonome™ – an agebiotic that induces the release of antioxidants by a balanced microbiota protecting skin from visible signs of ageing. Æonome™ is metabolised by the commensal cutaneous microbiota enhancing the production and release of antioxidant metabolites (e.g. coumaric acid), protecting the skin cells from oxidative stress. It increases the ability of keratinocytes to produce ageless proteins involved in skin integrity, dermo-epidermal junction cohesion and endogenous antioxidants.

The ingredient is extracted from an ancient underwater cave located in Mallorca, where access is restricted to only researchers. This cave has remained preserved and protected for more than three million years. Æonome™ unveils itself as an agebiotic, a new approach to skin’s microbiome to unlock ageless properties.

The future of ageless beauty

Over the past decade, brands and retailers have made significant strides to cater to under-represented communities. While age inclusion has thus far been somewhat lacking from the conversation on diversity in beauty, times are changing. Brands are increasingly introducing more products for Gen Xers with a range of new launches confirmed in 2020 from major players including L’Oréal Paris and Clarins. And, with a new emphasis on a healthy ageing process, the beauty industry continues to move forward embracing inclusivity and ageless beauty, creating a more diverse product offering that appeals to the rising ageing population globally.

Also on the Road to in-cosmetics Asia Series…

Beauty & technology: ready for the future of cosmetics? | Episode 3

Gen Z: What do they look for in personal care & beauty products? | Episode 2

Personalisation within cosmetics and beauty | Episode 1

Sources

[1] Global Beauty and Personal Care Trends 2030, Mintel, 2020